new mexico solar tax credit form

New Mexico solar tax credit 2021. However this amount cannot exceed 6000 USD per taxpayer in a financial year.

New Mexico Solar Incentives New Mexico Solar Company

The federal solar tax credit is calculated as 26 of the total value of your solar system which consists of parts labor permitting and others.

. New Mexico state tax credit. 1Name MFirst Name I Last Name Phone Number with Area Code. Ad Instal solar panels for your home.

However it can take some time. Cash back offers on solar panels. This is the amount of renewable energy production tax credit that may be claimed by the claimant for the current tax year.

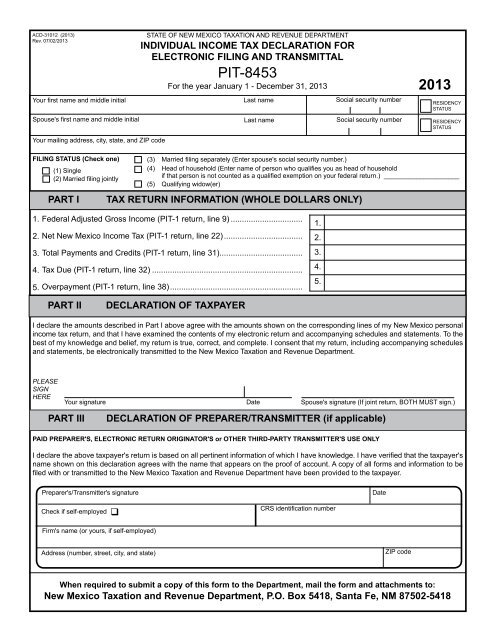

The process requires some certifications and filling out forms which can extend the timeline. The starting date for this tax credit is March 1 2020 and the tax credit runs through December 31 2027. SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1.

Ad These kits are versatile in use and great for starting any solar adventure. Lets say you install an 18000 solar panel system on your home. Tax Credit Forms Directions 1.

This form has become simpler to file now than in previous years but still has some complications. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit. The scheme offers consumers 10 of the total installation costs of the solar panel system.

Since most average sized 6kW systems cost about 18000 you can expect a credit of about 1800. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. If the credit amount surpasses your tax amount for the taxable year the remaining credit can be carried over for the next five years.

Form BCA Residential Solar NMAC 3314 Solar System Installation Form- BCA New Solar Market Development Income Tax Credit Form BCA Asterisk indicates required information. There is a cap of 8 million in tax credits to be issued every year on a. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability. Take advantage of Solar tax credits. The New Mexico Solar Income Tax Credit works very similarly to the federal ITC.

So the ITC will be 26 in 2020 and 22 in 2021. NM Taxpayer Information. The process to claim the New Mexico solar tax credit is simple.

For instance if your New Mexico solar. Local Building Authority. New Mexico Finance Authority.

Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Following the purchase of a solar installation the homeowner can file for a New Mexico state tax credit. The Solar Market Development Tax Credit provides a tax credit of 10 for small solar systems including on-grid and off-grid PV systems and solar thermal systems.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. Federal Solar Tax Credit. This new legislation gives a 10 income tax credit to homeowners who purchase solar equipment and installation.

Form BCA Solar PV System Installation Form. This is an amazing opportunity to take advantage of this tax credit and invest in the future of energy. Even before the return of the state tax credit switching to solar in New Mexico would bring you substantial savings on your electric bill.

As of July 2016 there were 973 MW 2148000 MWh of projects in the waiting queue for the windbiomass tax credit and 1103 MW 2369000 MWh of projects in the waiting queue for the solar tax credit. Form 4 ST Tax payer and Contractor Statement of Understanding. Multiply line 5 by line 6.

Double-click a form to download it. Buy and install new solar panels in New Mexico in 2021 with or without a home battery and qualify for the 26 federal solar tax credit. 12790 Approximate system cost in NM after the 26 ITC in 2021.

Allow the pop-ups and double-click the form again. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems. The New Mexico Solar Market Development Tax Credit or New Mexico Solar Tax Credit was passed by the 2020 New Mexico Legislature and signed by New Mexico Governor Michelle Lujan Grisham.

This credit is worth 10 percent of the cost of the system or 6000 whichever is lower. You will then file for the tax credit with your tax return before April the following year using the Form 5695. 364 New Mexicos Energy Efficiency and Renewable Energy Bonding Act which became law in April 2005 authorizes up to 20000000 in bonds to finance energy efficiency and renewable energy.

The federal solar tax credit. Form 4 PV Tax payer and Contractor Statement of Understanding. New Mexico state solar tax credit.

Expand the folders below or search to find what you are looking for. Name Administrator Budget Last Updated End Date DSIRE ID Summary. 7 Average-sized 5-kilowatt kW system cost in New Mexico.

Form 3 Solar Thermal System Installation Form. Form TRD-41406 New Solar Market Development Tax Credit Claim Form is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy Minerals and Natural Resources Department. The New Solar Market Development Income Tax Credit forms.

See form PIT-RC Rebate and Credit Schedule. Fill Out the Application. But the new solar tax credit really pushes your savings over the top making solar an even better investment than it was in the past.

Clean Energy Revenue Bond Program. Ideal For Off-grid Applications Including RVs Trailers Boats Sheds CabinsBuy Now. Form BCA Solar Themal System Installation Form.

It covers 10 of your installation costs up to a maximum of 6000. See below for forms. The New Mexico Energy Minerals and Natural Resources Department EMNRD.

6 rows New Mexicos Solar Market Development Tax Credit provides a personal income tax credit for. 07152015 State of New Mexico - Taxation Revenue Department SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Schedule A Once a credit application is approved by EMNRD complete and attach Form RPD-41317 Solar Market Development Tax Credit Claim Form including Schedule A to your New Mexico income. Low up front costs.

More NM Tax Credits. It is taken in the tax year that you complete your solar install. Enacted in 2002 the New Mexico Renewable Energy Production Tax Credit provides a tax credit against personal or corporate income tax.

The tax credit applies to residential commercial and agricultural installations. Form 5 BusinessLLCLLP Form. The balance of any refundable credits after paying all taxes due is refunded to you.

Thats right youll get back 10 of the cost of the solar panels and the installation cost. The residential ITC drops to 22 in 2023 and ends in 2024. One of the top and most popular solar incentives in the United States is from the Federal government.

The bill states that a business or homeowner who purchases. State of New Mexico - Taxation and Revenue Department RENEWABLE ENERGY PRODUCTION TAX CREDIT CLAIM FORM ____ ____ ____. The New Mexico solar tax credit is Senate Bill 29.

Claiming the New Mexico Solar Tax Credit. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers. Signature of taxpayer Date RPD-41317 Rev.

Your browser may ask you to allow pop-ups from this website. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower. Your state tax credit would be equal.

New Mexico Energy Tax Credit Rebates Grants For Solar Wind And Geothermal Dasolar Com

Solar Panel Financing Options New Mexico Solar Energy

New Mexico Solar Incentives New Mexico Solar Company

Form Taxation And Revenue Department State Of New Mexico

New Mexico Solar Incentives New Mexico Solar Company

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance

Tribal Communities Use Corporate Investment For Solar Power Time

What Are The New Mexico Solar Tax Credits

What Is Holding Back Renewable Energy Development In Indian Country Clean Energy Finance Forum

New Mexico Solar Incentives Rebates And Tax Credits

Solar Panel Monitoring System Nm Solar Group

New Mexico Solar Gross Receipts Tax Grt Exemption

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

New Mexico Solar Incentives New Mexico Solar Company

A Colorado Steel Mill Is Now The World S First To Run Almost Entirely On Solar

Executive Insights Solar In New Mexico Albuquerque Business First

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance